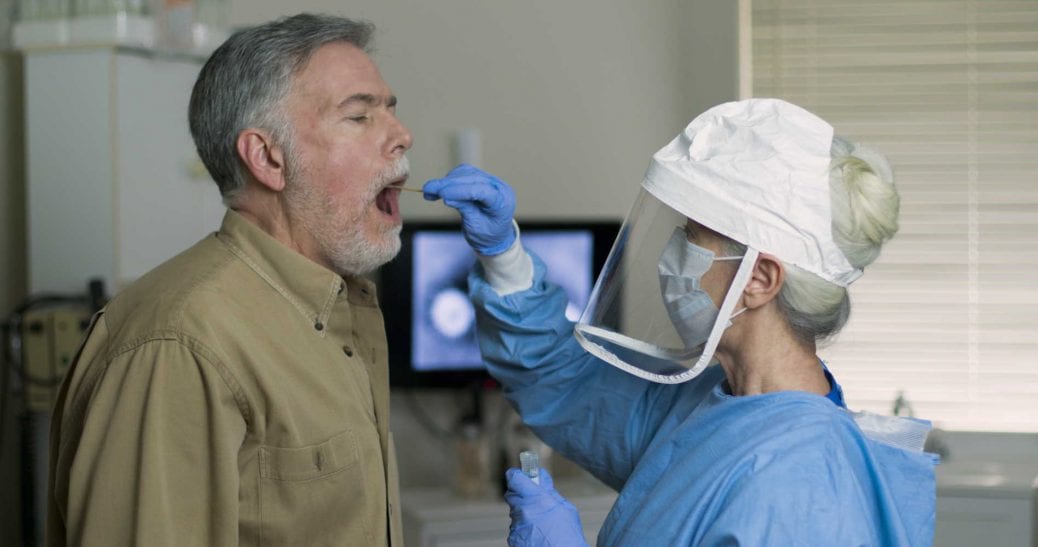

Healthcare providers face both humanitarian and economic stress with the COVID-19 pandemic. The response to the crisis is changing how care is provided.

Everywhere established protocols and practices are being revisited. Many new initiatives are helping provide both lifesaving care for those impacted by the pandemic and routine care for patients whose regularly scheduled visits with their providers have been interrupted.

Leadership teams of healthcare providers are dealing with unprecedented levels of demand in their hospitals and facing questions about how to provide optimal care. They have also to face pressing questions about what the future of healthcare may look like during COVID-19 and immediately after it.

The experience of the last months has shown the potential for fundamental changes across the care continuum. These changes include the design of facilities, the increase in capabilities, the training of healthcare workers, the sourcing and inventory management of critical care equipment and personal protective equipment (PPE), and the settings for care delivery and how it is reimbursed or charged. Some trends in these respects were underway before the pandemic and likely will now be accelerated.

The healthcare response to COVID-19 will remain a priority at least until late 2021, as countries implement phased relaxations and restrictions to suppress the virus, expand testing and treatment capacity, find therapies, and wait for universal vaccination. The success of most providers will be determined by their ability to adjust in the next months and to the new normal, dealing with a specific set of challenges, and capturing new opportunities at speed.

We have identified four key shifts across the healthcare delivery value chain across the world:

- New paradigms for infrastructure, distribution of providers, and care settings;

- Operational excellence, which will be critical in the new normal;

- The emergence of new growth opportunities and diversification; and

- Focus on the consumer-patient archetype.

While we focus on successful actions from several countries, the magnitude of these changes will depend on the specific context in each market.

1. New paradigms for infrastructure, distribution of providers, and care settings

Flexible design and greenfield facilities designed to enable faster re-purposing

Greater agility in how hospitals are architected and built is now a prime focus. Designs that maximize infection control (for example, more single rooms, flexible HVAC systems) as well as how the capacity for intensive or critical care is integrated into the hospital layout and user experience, with the ability to quickly convert regular beds to intensive/crucial care beds, will be given more importance. Providers may need to examine their ability to scale up and create multifaceted resources.

Providers with large footprints in locations with an already strained intensive care unit (ICU) capacity may consider establishing intensive care hubs of excellence. These hubs may be centralized rather than spread through all their institutions. This centralization can create benefits of concentrating expertise and capturing economies of all types (not just of scale) and can also offer the opportunity to leverage remote monitoring technology that improves economies of scale for scarce skills.

A shift toward virtual ICU (that is, eICU) models is underway. Mercy Hospital in Australia is an example where patients are at home and intubated with a nurse in attendance while critical care specialists monitor patients remotely.

Delivery of elective care in dedicated facilities

While elective care is curtailed/postponed across many countries, patients requiring high risk/complex care, such as those with cancer, may not be able to wait for treatment. One potential response is dedicating specific areas, either within hospitals where COVID-19 patients are managed or in dedicated non-COVID-19 facilities, where elective care may be delivered. These facilities may become a permanent feature of the future healthcare landscape.

Acceleration of the online-offline integration

Numerous examples exist worldwide of virtual care—sometimes supplemented with artificial intelligence—that is now the first point of interaction for nonacute care.

A single, digital-first “front door” for health services is being established. The patient journey starts with an app or online and is then redirected to the optimal care setting regardless of physical or virtual modality. Multiple providers of digital solutions have been working with the National Health Service (NHS), for example.

A massive expansion of home-based care likely will be supplemented with artificial intelligence (AI). Virtual care via AI, phone-based diagnostics, and other virtual patient engagement platforms are expected to be part of this expansion.

Separation of ancillary functions, such as imaging and lab tests, from core hospital operations

In countries where these ancillary functions are still an integral part of the hospital operations (and are physically co-located in a hospital), their separation may be accelerated by the demand for more capacity for diagnostic testing during the emergency response to COVID-19. Providers may also see increasing demand for online consultation activities.

Growing categories of remote/online services will naturally require more input of clinical information. Some basic services can be fed through home-based devices, but more are expected to be collected through specialized facilities available in convenient locations, such as pharmacies, imaging centers, and pathology labs.

Accelerated transition to ambulatory care and day surgery

Inpatient stays are likely to remain undesirable. Patients may choose to avoid hospital stays whenever feasible, accelerating the transition to ambulatory care settings for increasingly complex care and procedures.

2. Operational excellence, a critical skill in the new normal

The financial performance of providers in the coming years will be impacted by several factors, including the macroeconomic performance and recovery of the country, the pace at which elective care returns, and the agility of the leadership in adapting their operating models to these changing circumstances.

Prolonged revenue growth challenges

Revenue growth may remain challenging for a prolonged period, driven by the overall pace of the economic recovery and specific trends related to private providers.

Premium volumes may be reduced in view of increased unemployment, challenging economic situations for employers, and the focus of public sector budgets on funding the recovery of the broader economy.

Emergency room visits may decline or shift to online platforms given concerns about community transmission of the virus. Short- to medium-term declines in admissions for elective care/procedures are likely, which will require providers to manage operations more efficiently.

A new set of costs will challenge margins

Labor costs may rise in some markets as healthcare worker shortages in selected disciplines emerge, particularly in critical care disciplines. A growth in task-shifting models may also follow (potentially with higher wage bills) to leverage non-specialists (for example, primary care physicians, nurses) to deliver more complex care to patients when shortages occur.

More sophisticated value chains may emerge. This shift could result in higher inventory costs as providers implement more stringent requirements on safety stocks of PPE and consumables needed to run cardiac care units (CCUs) and ICUs. Providers may need to develop new capabilities in dynamic inventory management to comply with local policies, monitor expired supplies, and maintain stockpiles with suppliers. Some may consider forming/joining hub-based warehouse models, where a group of smaller providers contributes to the operational costs of maintaining larger stockpiles. Having real-time inventory and supply/demand data could significantly reduce costs. Some providers also may examine expert guidelines around sanitizing and reusing supplies.

Capital expenditure costs also may increase as some providers build larger community networks or undertake necessary upgrades to existing facilities.

3. The emergence of growth opportunities and diversification

New growth opportunities

Providers may look to new opportunities such as telehealth consultations, home healthcare services, non-ER-based primary community care, and more proactive regular health screening. Providers may be faced with several strategic choices:

- Licensing third-party telehealth services/solutions versus building their own offerings

- Expanding into community-provided primary care services focused on selected clinical disciplines (for example, pediatrics, obstetrics, gynecology)

- Expanding into the provision of remote behavioral health services and screenings, with the assumption that payers will be willing to reimburse for these services

Innovative arrangements between the private and the public sectors

Governments are already exploring innovative partnerships with the private sector to manage the crisis. These partnerships may continue in the future and could take many forms, including funded mandates for capacity:

- The NHS has secured short-term capacity (beds and critical care personnel in the private sector effectively underwriting short-term sustainability).

- The Australian government is partnering with the private sector to utilize their capacity to help manage anticipated demand in the public sector.

Consolidation of smaller providers

Smaller providers may struggle to remain solvent as elective care volumes decline and “discretionary” ER visits dry up. They could become the target of acquisitions by players who have the scale and balance sheets to withstand the expected upcoming financial stress. This trend is already becoming apparent, as companies across markets have issued earnings guidance.

4. The Consumer-Patient Archetype

Aligned with the new normal model is the increased focus on the Consumer-Patient archetype. Essentially, the Consumer-Patient archetype brings together two previously well-established and pre-defined approaches to healthcare, namely the patient-centered care approach and consumer-directed commercial models.

With reference to the Consumer-Patient archetype, the role of social media is becoming increasingly more dominant in the realm of healthcare. The implications of this are not only limited to information dissemination or marketing standpoint. In fact, it requires a more interactive and better understanding of patient behavior and values. Consequently, more can be done in terms of influencing lifestyle choices and encouraging healthier behaviors. Given that the upcoming challenge of rising treatment costs due to chronic diseases is one that health systems must find effective ways to deal with, a new patient-centered approach is likely to improve the odds of success. The task of having increased patient engagement extends beyond just the social media component. It also involves a greater understanding of a redesigned paradigm for understanding and influencing patient behavior.

Five key components of the archetype:

- Use insights from behavioral studies (psychology and economics) to increase individual engagement in health matters.

- Integrate behavior change as a core component within new healthcare delivery models.

- Leverage the power of influencers and social networks to support and drive health behavior change.

- Adopt remote monitoring and self-care technologies to support and empower individuals and establish linkages to clinicians and influencers.

- Encourage multi-stakeholder involvement which includes public and private sector partnerships across the healthcare ecosystem.

How to adjust to the new normal

For these changes to happen, accelerated progress is needed across several areas:

- Technological advancements, which would include AI-based diagnostics, cloud-based storage of medical records, and integration of information across the care continuum in and outside the hospitals. Digital tools to facilitate remote communication between providers and patients will continue to be developed and improved, in conjunction with point-of-care devices and home-based monitoring devices. Additionally, real-time data can create effective use of supplies and allow staff to work efficiently.

- Greater flexibility in reimbursement models from payers, and for telehealth and home healthcare services. This model may require payers to have evidence that telehealth is providing similar/better outcomes (for example, data indicating that more convenient refills enable better compliance among patients with chronic diseases).

- Consumer adoption, which will be driven by more informed consumers demanding a seamless technology experience irrespective of the care setting. Consumers may want the ability to have end-to-end delivery of care, including home/office delivery of medications. The ability to build trust in the new care setting is also critical to sustain the continued use of online/home-based services. New incentives and capability building to sustain the new operating model will also be needed.

- Regulatory changes to licensing healthcare workers with a broader set of skills, more flexibility (with a move away from setting ratios and input metrics), institutions with multi-purpose beds, as well as e-prescribing and delivery of medications with more flexible use of supplies. Given the disruption of clinical trials in many parts of the world, the demand for real-world evidence may grow. Regulators may need to develop new frameworks, especially as more service activities shift from hospitals to out-of-hospital care settings.

The tremendous pressure on healthcare workers and institutions over the past few months cannot be brushed aside, especially considering the physical and psychological toll of the COVID-19 crisis. However, as new initiatives develop in the new normal, providers will implement them and be able to treat patients across the care continuum.

Sources: (1) Healthcare Providers: Preparing for the next normal after COVID-19 - McKinsey (2) Healthcare 3.0 - Healthcare for the new normal - Deloitte (3) Creating the New Normal: The Clinician Response to Covid-19 - NEJM